TOPICS/ISSUES

Nigerian Tax Compliance Review Exercise

The Nigerian Federal Inland Revenue Services (FIRS) are sending letters alleging that certain named vessels have traded to Nigeria between 2010-2019 and have not filed Companies Income Tax (CIT) returns nor paid taxes to the Nigerian government.

Members are advised to be alert to the possibility of receiving letters from the FIRS which considers non-payment of the demands to be classified as tax evasion and a criminal offence.

Please see the INTERTANKO FAQs as well as the INTERTANKO Nigeria Advisory.

Members who have received a letter from the FIRS are urged to notify their P&I Clubs and INTERTANKO. INTERTANKO also recommends taking into consideration the Advisory and consulting with local experts and insurers before engaging with the FIRS and when contemplating future calls to Nigeria.

If you have further specific issues you believe we can assist with, please contact LegalandDocumentary@intertanko.com.

FAQS

INTERTANKO’s position is that the retrospective Tax Compliance Review Exercise should be dispensed with having achieved the result of drawing to the international shipping community’s attention that the FIRS consider that freight income attributable to Nigeria is taxable from non-residents.Instead INTERTANKO has requested that the FIRS now focuses on tax compliance going forwards.INTERTANKO’s letter to the FIRS first setting out this position can be found here.

The below FAQs are for information, and are not INTERTANKO recommendations, and are drawn from comments made by local experts including KPMG, Bloomfield LP and Ascension Consultancy Services in a webinar on 11 July as well as Babajide Koku & Co and also from comments made by the FIRS and exchanges INTERTANKO has had with them on behalf of Members..

Who are the demands being sent to?

The FIRS has said that it is issuing assessment notices to non-resident entities within the maritime sector that carried out operations in Nigeria during the period 2010-2019 who are allegedly liable for tax pursuant to Section 14 of the Companies Income Tax Act (CITA). This is said to include both vessel owners and charterers depending on the nature of their involvement in the transaction in Nigeria.

INTERTANKO is aware of demands being sent to agents as well as ship owners and operators but is unaware of any demands being sent to charterers. INTERTANKO is also aware that demands have been circulated listing hundreds of vessels.

The first set of demands were sent in May and June 2023. It now appears that a new set of demands pertaining to different vessels/ alleged claims are being sent in August 2023.

What are the demands claiming?

The demands, now called letters of intent by the FIRS, refer to a public notice for tax compliance of international shipping lines deriving income from Nigeria and refers to a circular from the FIRS from 2021 on the taxation of companies engaged in shipping, air transport and cable undertakings.

The demands allege that certain named vessels have traded to Nigeria between 2010-2019 and have not filed Companies Income Tax (CIT) returns nor paid taxes to the Nigerian government. Details of the vessels and the summary of alleged liability payable for listed years are said to pertain to total gross freight, tax payable on this freight of 6%, a penalty of 10% and interest at 19%.

INTERTANKO has noted that a named vessel may be listed on more than one demand but is so far unaware of a duplication of any listed years.

How has the tax been calculated?

The FIRS says that it is aware of the gross freight revenue earned on each voyage due to intelligence reports from other government agencies in the maritime sector and that this is the basis for its assessments.

INTERTANKO has received comments from some Members that the total gross freight figures do not correlate to actual figures and that some vessels were on a time charterparty basis.

Local experts’ advice is that where there is an uplift to freight for e.g. future equipment taxes are likely to be calculated including the uplift.

Is this a new tax?

The FIRS have said that the tax and CITA, the relevant act, are not new but the new tax policy of the Nigerian Federal Government is that the tax is now being enforced due to fiscal challenges and to generate revenue for the Nigerian government. CITA was enacted by Nigeria in 1961 with Section 14 in force since 1978.

If a Member has received a demand what should they do?

The May and June 2023 demands state that the relevant assessment notices and demand notes based on computed tax liabilities are being prepared to be forwarded for settlement. The Association is not aware that any assessment notices and demand notes have yet been received.

According to the FIRS, there is a statutory timeline of 30 days from the date of service of the assessment/demand notice in line with Section 69(2a) of the CITA to include the following:

“(2) An application under subsection (1) of this section shall—

(a) be made within thirty days from the date of service of the notice of assessment; and

(b) contain the ground of objection to the assessment, that is—

(i) the amount of assessable and total profits of the company for the relevant year of assessment; and

(ii) the amount of tax payable for the year, which the company claims should be stated on the notice of assessment.”

The August 2023 letters of intent do not refer to any relevant assessment notices and demand notes being prepared to be forwarded for settlement. Instead, they state that “As a measure of goodwill, the Federal Government has decided to grant a 3-month window for international shipping companies operating in Nigeria to regularize their tax status in Nigeria and another 3-month window for payment of all their outstanding taxes to the Federal Government of Nigeria. Your company is hereby advised to consider this demand notice and take advantage of the 6-month extension to file its tax returns up to 2023 years of assessment and pay all outstanding tax liabilities to forestall higher penalty and interest”.

Members who have received a letter from the FIRS are urged to notify their P&I Clubs and INTERTANKO.

According to the FIRS presentation at the Nigerian Chamber of Shipping webinar on 4 July 2023, the FIRS expectation of those who had received a demand, which they called a letter of intent, is as follows:

1. “Response to the letters of intent within thirty (30) days of receipt of the letter

2. Provide useful feedbacks either liable or not

3. Registration with FIRS https://taxpromax.firs.gov.ng

4. Industry reconciliation in case of objections

5. Payment of agreed liability in line with the law

6. Self assessment for 2020 to 2022/2023

7. Take advantage of the treaty benefits in line with FIRS circular on claim of treaty benefits”

The recommendation of local experts is that from a practical perspective, parties should engage with the FIRS as soon as possible and prior to receiving the assessment notices and demand notes.

We would suggest that any engagement Members have with the FIRS should be done in consultation with Members’ P&I Club and local advice so that repercussions of the retrospective Tax Compliance Review Exercise as well as any future tax obligations can be considered.

What is the 6 months’ grace period and how does that work with the letters of intent?

On 19 June, Special Adviser to the President on Revenue, Zacheus Adedeji, spoke to the press and stated that a technical committee comprising of “ the regulator, which is NUPRC, NMDRA, NNPC, Federal Inland Revenue Service and the Presidency, in the Office of Chief of Staff, SA Energy and SA Revenue and the Secretariat will be the Federal Inland Revenue. The technical committee will look at the concerns and reconcile the back taxes and set a process that will ensure compliance going forward. So, we’ve agreed to give the parties three months to come to the conclusion and we will also give a grace period of six months, when we will not enforce any of these laws, just to allow for reconciliation. In essence, no vessel or ship will be detained or delayed. So, we give this six months break for them so that they can reconcile with this technical committee that we set up”.

In the FIRS response to INTERTANKO of 25 July 2023, they confirmed that the Federal Government of Nigeria has granted a 3-month window commencing from 19 June 2023 for international shipping companies to “regularize their tax status in Nigeria” and another 3-month window from 19 September 2023 “for affected companies to pay all their outstanding taxes”.

Local experts’ advice is that parties should engage with the FIRS as soon as possible and not wait until the end of the 6 months. The 6 months’ grace period expired on 31 December 2023. Please see the section below on the extension of the reconciliation period to March 2024.

Mr Zacheus Adedeji has now been appointed the Executive Chairman of the FIRS.

If a follow up to a May or June 2023 letter of intent has been received, is this the assessment notice and demand note referred to in the original letter?

INTERTANKO is aware of follow up letters dated August 2023 being received by Members which refer to the original letter of intent.

Similar to the new August 2023 letters of intent, these follow up letters state that “As a measure of goodwill, the Federal Government has decided to grant a 3-month window for international shipping companies operating in Nigeria to regularize their tax status in Nigeria and another 3-month window for payment of all their outstanding taxes to the Federal Government of Nigeria. Your company is hereby advised to consider this demand notice and take advantage of the 6-month extension to file its tax returns up to 2023 years of assessment and pay all outstanding tax liabilities to forestall higher penalty and interest”.

There are differing local views as to whether these follow up letters constitute the assessment notices and demand notices referenced in the original letter of intent but that does not alter local advice that parties should engage with the FIRS as soon as possible and not wait until the end of the 6 months. The stated deadline in these letters is 31 December 2023. However, the FIRS have since confirmed that these letters did not constitute the assessment notices and demand notices referenced in the original letter of intent.

INTERTANKO is also aware of two types of follow up letters dated November 2023 being received by Members:

- Letters where there has been no engagement with the FIRS by Members

This letter refers to an earlier May letter and sets out calculations of tax payable on total gross freight for certain named vessels. Unlike earlier letters, there is a reference to this letter being the actual “Assessment”, referring to section 69 of CITA and a deadline of 30 days from the date of the letter in which to respond.

- Letters where there has been engagement with Members

This letter asks for documentary evidence of the position put forward by Members including invoices from Members for the cargo lifted, other documents including evidence of payment of a Nigerian Maritime Administration and Safety Agency (NIMASA) levy. A short deadline was given for the provision of documents and an in-person reconciliation meeting.

Following a FIRS stakeholder engagement workshop on 20 November 2023, the FIRS have revised their expectations if a company has received a letter from them. Please see the section below on the extension of the reconciliation period to March 2024.

What is the extension of the reconciliation period?

On 20 November 2023, the Oil Producers Trade Section (OPTS) organised a FIRS stakeholder engagement workshop in which INTERTANKO took part. INTERTANKO’s intervention can be found here. Due to poor sound quality of the workshop, there was also a debrief from the FIRS on 23 November 2023.

The FIRS have said that taxpayers have a statutory timeline of 30 days from the date of service of an assessment/ demand notice in line with Section 69(2a) of the Companies Income Tax Act (CITA). Where any company disputes the assessment, under section 69(1) of the CITA, the FIRS expects Members to apply to the FIRS by notice of objection in writing to review and revise the assessment. Please also see the INTERTANKO Nigeria Advisory which sets out some of the information that a company is likely to be asked to provide.

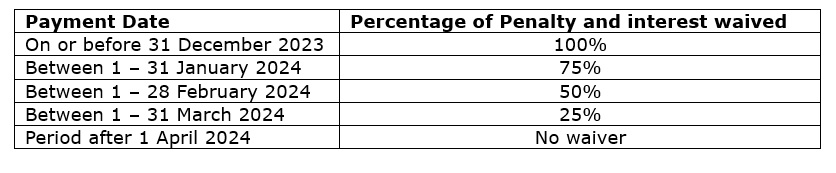

If the tax position is reconciled between the FIRS and the company then, dependent on when payment is made there may be a waiver or reduction of penalty and interest claimed as follows:

What if freight tax has already been paid through agents and reflected in port disbursements?

If an agent has paid tax on your behalf, some sort of return should have been received. You will need to prove to the FIRS that the tax due on that particular freight has been paid and that tax will not have to be paid again. However, it is possible that an agent has a separate tax obligation in Nigeria and the terms of the contract will need to be considered and whether both you and the agent retain an obligation to pay tax in Nigeria.

If this is a freight tax, is an Owner under a time charterparty who is not earning freight, liable to pay?

Local experts’ advice is that if an Owner under a time charterparty was not earning income derived from freight then they should explain this to the FIRS and provide evidence of the relevant party who did earn freight.

In their letter of 16 October, the FIRS say that “Where any owner is not the recipient of the freight income, he is expected to prove same by furnishing FIRS with the details of the charter party (or parties to the arrangement) that earned freight income”.

However, although the current focus of the FIRS is on freight tax, other streams of non-freight income may be liable to tax in Nigeria. An Owner under a time charterparty who is not earning freight may therefore find themselves liable to be taxed under a different tax framework which could include income from demurrage.

In the debrief of 23 November 2023, the FIRS confirmed that companies who did not consider that they had to pay tax as they did not earn freight, might still be liable for some other form of tax as non-freight income may be regarded as taxable income.

The FIRS have not confirmed what other forms of tax are due and how they are to be calculated.

In seeking to reconcile the position on tax on freight, companies should therefore be mindful they might receive claims from the FIRS for other forms of non-freight tax.

What should a Member do if they have not received a letter of intent but are aware that their vessels are named on one of the demands that lists hundreds of vessels?

The recommendation from local experts is that to the extent that you have operations in Nigeria during the relevant period then you should begin to review your records so that you have a position in place for when a letter of intent is received. In the event no letter of intent is received, measures should be taken to ensure compliance going forwards.

In the debrief, the FIRS encouraged any companies that had not received a letter of intent, but thought they might do so if their vessels had called in Nigeria, to self-assess for the period 2010-2022. Providing the self-assessment is completed and payment is made within the concession dates then the waiver on penalty and interest would apply.

How does the freight tax affect a ship manager?

The view from local experts is that it depends on the nature of the ship management contract in place but even if a ship manager has not derived income from Nigeria, they will need to verify their role and provide the relevant information to the FIRS and should be advising their owners of the same.

What happens if a Member no longer owns a ship for which it has received a letter of intent?

The local advice is that if the Owner derived income for the relevant period then the FIRS will still want this to be declared. If the vessel had been sold and traded by someone else at the relevant period then the FIRS should be informed of the change of ownership.

What should Owners of time chartered vessels do to protect themselves in relation to future liability for calls to Nigeria?

The FIRS has stated that under the Finance Act 2023 regulatory agencies in the maritime sector are now required to mandate shipping companies operating in Nigeria to present “evidence of income tax filings for preceding years” and “tax clearance certificates validly issued by the FIRS” as the basis for obtaining regulatory approvals to load cargoes from Nigeria.

The FIRS have said that they want companies to register with them and tax returns are to be filed either on a deemed income basis or actual income basis.

Please see the INTERTANKO Nigeria Advisory for further information on what is required to file annual tax returns in the FIRS and also requirements under the recently enacted Finance Act 2023 and amended Section 14(6) CITA.

Owners should also consider the terms of their time charterparties. INTERTANKO will consider the drafting of an appropriate clause in due course.

What key resources do INTERTANKO have on this issue?

Key resources can be found here. If you are not an INTERTANKO member but would like a copy of some of the resources material listed below then please do contact LegalandDocumentary@intertanko.com.

Background information

- FIRS Circular 2021/14 on taxation of companies engaged in shipping, air, transport and cable undertakings dated 3 June 2021

- FIRS Public notice for tax compliance of international shipping lines deriving income from Nigeria dated 17 December 2021

- FIRS Circular 2022/15 on the claim of tax treaties benefits and commonwealth tax relief in Nigeria dated 11 May 2022

- Companies Income Tax Act

- Statement from Special Adviser to the President on Revenue Zacheus Adedeji 19 June 2023

- FIRS presentation at Nigerian Chamber of Shipping webinar 4 July 2023

- FIRS information circular on the claim of tax treaties benefits in Nigeria

- KPMG Memo of FIRS/OPTS engagement 20 November 2023

- FIRS presentation at FIRS/ OPTS engagement 20 November 2023

- OPTS presentation at FIRS/ OPTS engagement 20 November 2023

- INTERTANKO Advisory 11 December 2023

Correspondence between INTERTANKO and Nigerian Government

- INTERTANKO letter to FIRS dated 13 June 2023

- FIRS reply to INTERTANKO dated 14 June 2023

- INTERTANKO letter to FIRS dated 10 July

- FIRS response to INTERTANKO dated 25 July 2023

- INTERTANKO response dated 1 September 2023

- FIRS response dated 16 October 2023

- INTERTANKO letter to the Chairman of the House Committee on Petroleum Resources (Midstream) 13 September 2023

- INTERTANKO submission to Nigerian Presidential Committee on Fiscal Policy & Tax Reforms 14 November 2023

- INTERTANKO Intervention for FIRS/ OPTS engagement 20 November 2023

- FIRS written response following FIRS/ OPTS engagement 20 November 2023

- INTERTANKO response 11 December 2023

- INTERTANKO letter dated 25 January 2024

- FIRS response dated 13 March 2024

Guidance from local experts

- KPMG – Preliminary Advice and Podcast

- Bloomfield LP/ Ascension Consultancy Services Briefing

- KPMG presentation from INTERTANKO webinar 12 July 2023

- Bloomfield LP/ Ascension Consultancy Services presentation from INTERTANKO webinar 12 July 2023

- Babajide Koku & Co. newsletter

- KPMG – Follow up advice

- Babajide Koku & Co – Follow up advice

- Babajide Koku & Co – Meeting with FIRS

- Banwo & Ighodalo – Advice

Latest on Nigerian Tax Compliance Review Exercise

Nigerian tax reform bills passed into law

In a press release, Bayo Onanuga, the Special Adviser to the President of Nigeria for Information and Strategy, announced that President... MORE

INTERTANKO’s Insurance and Legal Committee meets in London

INTERTANKO’s Insurance and Legal Committee met on 13 March in London under new Chair Andrea Berlingieri (Premuda SpA). The meeting... MORE

INTERTANKO intervention on Nigeria Tax Bills

In our Weekly News article dated 14 February, it was noted that the Chairman of the Nigerian Presidential Committee on Fiscal Policy and... MORE

Update on Nigeria Tax Reform Bills

As reported in our Weekly News article dated 24 January, the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms,... MORE

Nigeria Tax Reform Bill expected to be enacted into law by end Q1 2025

It has been reported that in a speech at the Lagos Chamber of Commerce and Industry’s 2025 Economic Review and Outlook Conference,... MORE

Key Resources

Nigerian tax compliance: links to further information

Background information FIRS Circular 2021/14 on taxation of companies engaged in shipping, air, transport and cable undertakings dated 3 June... MORE